Some Known Incorrect Statements About Estate Planning Attorney

Some Known Incorrect Statements About Estate Planning Attorney

Blog Article

Getting My Estate Planning Attorney To Work

Table of ContentsExamine This Report about Estate Planning AttorneyOur Estate Planning Attorney StatementsEstate Planning Attorney Can Be Fun For AnyoneSee This Report about Estate Planning Attorney

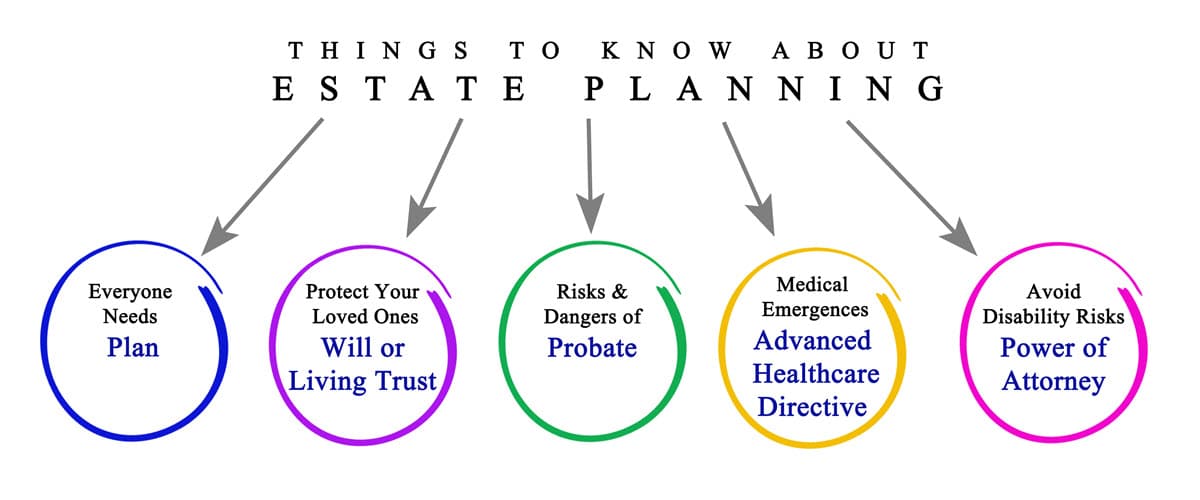

Estate preparation is an activity plan you can use to establish what occurs to your assets and obligations while you live and after you pass away. A will, on the other hand, is a legal file that describes exactly how possessions are distributed, who deals with children and pets, and any various other wishes after you pass away.

The executor additionally has to repay any kind of tax obligations and financial debt owed by the deceased from the estate. Creditors generally have a limited amount of time from the date they were notified of the testator's death to make cases versus the estate for money owed to them. Insurance claims that are rejected by the executor can be taken to court where a probate court will certainly have the last word regarding whether or not the case is valid.

Estate Planning Attorney Fundamentals Explained

After the stock of the estate has been taken, the value of properties calculated, and taxes and debt settled, the administrator will then look for consent from the court to distribute whatever is left of the estate to the recipients. Any type of inheritance tax that are pending will certainly come due within nine months of the date of death.

Each specific places their properties in the trust fund and names a person other than their partner as the beneficiary., to sustain grandchildrens' education and learning.

Excitement About Estate Planning Attorney

Estate coordinators can function with the donor in order to lower gross income as a result of those payments or develop approaches that make best use of the effect of those donations. This is another strategy that can be used to limit death tax obligations. It involves an individual securing in the current worth, and hence tax obligation, of their residential or commercial property, while attributing the worth of future growth of that resources to an additional individual. This approach involves freezing the worth of an asset at its value on the date of transfer. Accordingly, the quantity of potential capital gain at death is likewise iced here are the findings up, enabling the estate planner to approximate their possible tax obligation responsibility upon fatality and much better prepare for the settlement of earnings taxes.

If adequate insurance earnings are offered and the policies are properly structured, any type of revenue tax obligation on the deemed personalities of assets adhering to the death of a person can be paid without considering the sale of properties. Earnings from life insurance policy that are obtained by the beneficiaries upon the fatality of the guaranteed are usually earnings tax-free.

Other a knockout post charges connected with estate preparation consist of the prep work of a will, which can be as reduced as a couple of hundred dollars if you make use of among the ideal online will certainly manufacturers. There are specific documents you'll need as component of the estate preparation procedure - Estate Planning Attorney. Some of one of the most typical ones consist of wills, powers of attorney (POAs), guardianship classifications, and living wills.

There is a myth that estate preparation is only for high-net-worth individuals. However that's not real. Actually, estate preparation is a tool that everybody can make use of. Estate intending makes it easier for individuals to identify their desires prior to and after they die. As opposed to what many people think, it prolongs beyond what to do with properties and liabilities.

The Buzz on Estate Planning Attorney

You should begin intending for your estate as soon as you have any type of measurable property base. It's an ongoing procedure: as life proceeds, your estate strategy ought to move to match your conditions, in line with your new this contact form objectives.

Estate preparation is typically believed of as a device for the rich. That isn't the instance. It can be a useful way for you to handle your properties and obligations prior to and after you die. Estate planning is also a fantastic method for you to lay out prepare for the treatment of your minor kids and animals and to describe your want your funeral and favored charities.

Qualified applicants that pass the exam will certainly be formally accredited in August. If you're qualified to rest for the examination from a previous application, you might file the brief application.

Report this page